Table of Contents

What is a shelf company?

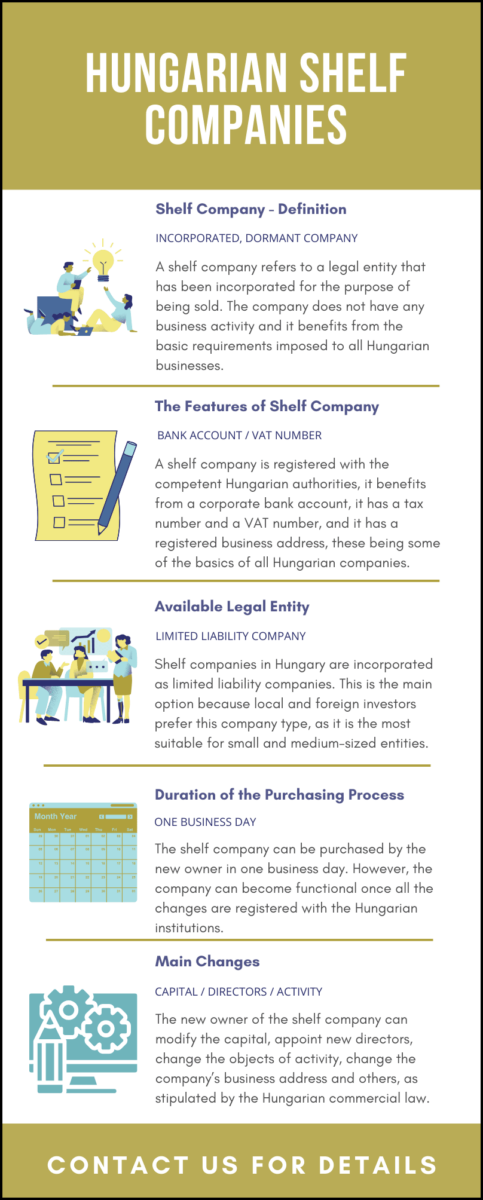

A shelf company in Hungary is an excellent option for foreign investors who do not want to register a new company in Hungary. These companies have already been incorporated but have been left dormant, meaning that they have no commercial activities but have all the incorporation documents in order.

The only step you will need to make in order to be able to begin working through your Hungarian company is to change the ownership of the company to your name. This is a simple process and our experts in company formation in Hungary can help you complete the paperwork in the shortest amount of time possible.

| Quick Facts | |

|---|---|

| Legal entities available for shelf company | limited liability company |

|

Time required for purchasing the company |

Basic purchase procedure can last one day, but the full registration process can take 8-15 days. |

|

Types of features it includes (corporate bank account, VAT number, etc) |

Already registered with the Court Register, no previous business activity, it has a registered office, corporate bank account, registered with the tax authorities, has a VAT number. |

| The advantages of a shelf company |

It can start its operations very fast, the new shareholders can make various adjustments (change the company's name, the directors, the object of activity), aged shelf companies are also available, has the same tax treatment as other local businesses. |

| Appointing new directors (yes/no) | Yes |

| Capital increase allowed (yes/no) |

Yes |

| Certificate of no commercial activities (yes/no) |

Yes |

| Modify the objects of activity (yes/no) | Yes |

| Participants in the purchase procedure | The procedure can be completed by company formation specialists, the new shareholders are not required to be present during the procedure unless they want to. |

| The cost of buying a shelf company | EUR 1,500 – EUR 4,000, depending on the characteristics of the company and its age. |

| Shelf company – definition | A shelf company refers to a legal entity that has been incorporated and benefits from the main registration characteristics of all companies, and which was incorporated for the purpose of being sold to a third party. |

|

Transfer of ownership |

The transfer of ownership of shelf companies in Hungary is done through the purchase agreement. |

|

Capital requirements |

There aren’t any capital requiremens, as the company already has the minimum capital subscribed in a bank account. |

| Institution in charge with the registration of the new owner | The Hungarian Court of Registration |

| Due diligence |

When buying shelf companies in Hungary, it is necessary to verify the documentation concerning its activities, debts, owners and any other financial matters. |

| Obligations after the corporate changes are made |

The new owner has to report any changes to the Hungarian Court of Registration. |

| Tax obligations of a shelf company |

Shelf companies are liable to the payment of the same taxes charged to any other commercial company. |

| Can shelf companies qualify for tax incentives and other benefits? |

Yes, there isn’t any difference between a shelf company and a company incorporated by the investors/their representatives. |

| Why is the LLC the main option for shelf companies? |

The LLC (limited liability company) is the most common option because the LLC is the the preffered legal entity chosen for incorporation in Hungary. |

| Basic management requirements for a Hungarian LLC | 1 shareholder, 1 director. |

| Residency requirements for the shareholder |

The shareholder doesn’t have to be a Hungarian resident. |

| Foreign ownership rules in Hungary |

Foreign investors can own 100% of the company’s shares. |

| Deadline to submit paperwork with the Hungarian registration authorities after the purchase |

8 days. |

| When can a legal entity be considered an aged shelf company? |

Aged shelf companies are the ones that have been incorporated for several years (minimum 1-2 years). |

| Where can one find available shelf companies in Hungary? | Contact our office for full list. |

What are the advantages of a shelf company in Hungary?

The main advantage of a shelf company in Hungary is that owners do not have to go through the company incorporation process and handle all the legal matters.

Another benefit offered by shelf companies in Hungary is that the company is already established on the market and this gives it credibility and age. This can be particularly useful for creditors and bidding on contracts.

A shelf companyhas a registered address in Hungary and we can also provide other services that will be needed after the company has commenced its activities, like accounting.

Accounting is a necessary component of any business activity and the way the financial documents are maintained and submitted must follow the rules of the Accounting Act. Our accountants in Hungary can assist all types of businesses in any accounting matter.

Of course, accountants can also prepare the financial statements, that must be prepared based on various characteristics of the company.

What you should know on Hungarian shelf companies

Although theprocess of company formation in Hungary will be avoided when purchasing a shelf-company (also referred to as a ready-made company), there are still numerous aspects that investors should comply with.

It is true that the investors will be able to start their operations much faster than if they have opted to open a company in Hungary following the standard registration process, but this doesn’t mean that the procedure is completely simple.

This is given by the fact that upon the purchase of the shelf company, the investor will have to sign specific documents. Upon the transfer of ownership, the new buyer must change specific aspects if this is necessary and, in specific cases, it is legally required.

For instance, the company must have a director, and the new owner must appoint a person to act as the director of the company.

Then, he or she may want to change the objects of activity of the company. Any change that is brought to the original registration information has to be reported to the Hungarian registration authorities, in accordance with the applicable law. In case you want to purchase a shelf company in another country, for example in Lithuania, we can put you in contact with our partners who are specialists in company incorporation matters.

The new owner also has the right to change the company’s business address to a new location.

Please mind that an advantage of this company type is that the investors are no longer required to submit a minimum share capital, as the company is already incorporated with the required capital.

This can have a positive impact when starting a local company, as the start-up costs businessmen have to invest in a new business are relatively large.

Given that the most important aspect involved in this procedure is signing the purchase agreement, it is highly recommended to be represented by local lawyers or by a team of specialists in company formation in Hungary.

Such specialists are qualified to oversee the entire process and, more importantly, to act on your behalf in the relation with the local institutions.

Once the document is signed, the papers have to be submitted with the Hungarian Court of Registration, which will take notice on the new ownership of the company and any other changes that were brought to the company.

As a general rule, since the day when the documents were submitted, the modifications will be registered in a period of maximum 8 days.

Foreign businessmen who want to open a company in Hungaryby buying a shelf company must know that they do not have to be present in Hungary at the moment when the purchase is made.

The procedure can be completed outside Hungary as well, but in this case, a much more complex procedure must be started, in the sense that the purchase documents can be signed from overseas, but the presence of a notary will be required, who must notarize the respective papers.

The advantage of a shelf company in Hungary is that it remained dormant since the moment when it was incorporated and evidence upon this will be provided to the new owner, who will have access to all the corporate documents issued throughout the years, since the moment of the incorporation.

Certified documents regarding its incorporation, the lack of business activities and the lack of corporate debts will be provided to the new owner once the sale-purchase agreement is signed.

It is necessary to know that you will not need to complete other standard steps for company registration in Hungary, such as registering for VAT or opening a corporate bank account, as the shelf company already provides all these.

However, the new owner of the company will still have to complete various formalities once the company becomes operational, such as:

- registering the employees for social security if the company will have employees;

- obtaining business permits in accordance with the new objects of activity of the company;

- obtaining various licenses for a new business office;

- another office premises (if necessary),etc.

What is the tax liability of a shelf company in Hungary?

Regardless if you want to open a Hungarian company following the standard registration steps or if you want to buy a shelf company, all corporate structures in this country have the same tax liability (this can vary based on the company type).

However, for a limited liability company incorporated following the basic steps or for a limited liability company purchased as a shelf company there aren’t any tax differences. The basic taxes refer to the following:

- • the corporate tax in Hungary is charged at a rate of 9%;

- • the VAT is charged at a standard rate of 27%;

- • the Hungarian tax institutions also charge reduced VAT rates of 18% and 5%;

- • the employment tax is charged at a rate of 15.5%;

- • the land tax is charged at HUF 200 per square meter or at 3% of the value of the property.

Is a Hungarian shelf company right for you?

Hungary has a medium sized economy but nevertheless it is an important business destination among the Central European countries. Hungarian companies incorporated by foreign investors can be fully owned and controlled by their foreign directors.

Shelf companies in Hungary can take the form of the most common business types used in the country, like limited liability companies. These types of companies have a variety of ages and names and investors can choose the one that best suits their business and commercial interests in Hungary.

Our team of specialists in company registration in Hungary offers you the possibility to purchase a ready-made company that has been incorporated recently in Hungary or that has a certain age and suits different business needs. Below, you can watch a short video on how to buy a Hungarian shelf company:

What are the advantages of an LLC shelf company in Hungary?

The most common legal entity available for a shelf company in Hungary is the limited liability company (LLC). This happens because the LLC is the most common business form that is selected for incorporation in Hungary.

The LLC is a common way to start a business because it offers many advantages, and it is the most suitable legal entity designed to fit the needs of small and medium-sized companies.

This company type offers many benefits, in terms of taxation, management, shareholding and many others and you can find out here some of the main advantages of this structure.

Of course, our team of consultants in company formation in Hungary remains at your service for any additional information that you may need.

In the list below, you can discover few of the main characteristics of this company type when it comes to its management:

- the LLC can be incorporated by 1 shareholder, who can be of any nationality;

- the shareholder of the Hungarian LLC does not need to be a resident of Hungary in order to be allowed to incorporate or to buy an LLC;

- the company must be represented by 1 director;

- the director is responsible for the administration of the company and the obligations the director has must be clearly established in the company’s statutory papers.

Another reason to purchase a shelf company in Hungary that is incorporated as an LLC is that the investor’s liability towards the company’s debts is limited to the capital contribution of that investor.

This one of the main advantages of this company type, as investors have limited liability while retaining all other benefits that can be obtained through the LLC.

In comparison, for other company types investors can be held accountable for the company’s debts with their personal assets, and this can become a potential factor of risk when developing a business activity.

Why choose Hungary as an investment destination?

Whether you want to open a company in Hungary or to purchase a Hungarian ready-made company, you must have clear information regarding the investment environment available in this country.

Matters concerning the taxation level, the top industries, the incentives offered to foreign investors, the economic and political stability of the country and many others are always of interest.

If you want to buy a shelf company in Hungary in order to start a business activity, it is important to know the following:

- • one of the most important economic activities in Hungary is automotive, accounting for 170,000 employees;

- • the country has an active workforce of 4,5 million persons (data measured for 2020);

- • when starting a business that will employ workforce, investors should know that they will need to pay EUR 470 as a minimum wage, while the average salary is of EUR 1,110 (calculated as a gross amount);

- • Hungary benefits from financial aid through the EU funds and a new call was open for the period of 2021-2027;

- • companies creating minimum 10 jobs related to research and development can qualify for certain subsidies.

Another advantage is the geographical location of the country, which connects Eastern Europe with Western Europe. Also, Hungary is known for its developed infrastructure and this can be of major importance for businesses.

Hungary has borders with many European countries, with which it has various import-export relations, depending on the needs developed through the years (such countries are both EU and non-EU states), as follows:

- Austria;

- Slovakia;

- Ukraine;

- Romania;

- Serbia;

- Croatia.

Prices for shelf companies can vary according to numerous aspects. For detailed information about the ownership transfer and prices, please contact our team, where you will find the necessary support in opening a company in Hungary.

We invite you to contact our consultants for additional advice on any legal matter of interest concerning the purchase of a shelf company in Hungary.