Starting a business in Hungary as a foreigner implies choosing a legal structure, preparing the incorporation documents in accordance with the selected entity and the registration with the Trade Register. With a vast experience in company formation in Hungary, our local specialists can guide foreign investors coming here with the purpose of doing business.

Businessmen who want to open a company in Hungary, should know that the Hungarian law on setting up new companies allows all interested persons to operate a business without limitation. Foreign individuals and legal entities can operate in all business areas, with some restrictions in agriculture. If the chosen activity requires a permit, such as banking activity, there are the same rules for residents or abroad entities.

We invite you to read below about the main steps to complete if you want to open a company in Hungary.

| Quick Facts | |

|---|---|

| Types of companies |

Limited liability partnership |

|

Minimum share capital for LTD Company |

3M HUF (∼ 8,300 Euros) |

|

Minimum number of shareholders for Limited Company |

1 |

| Time frame for the incorporation |

2-3 days |

| Corporate tax rate | 9% |

| Dividend tax rate |

Indifferent if the shareholders do not live in Hungary. |

| VAT Rate |

27% |

| Are Shelf Companies Available? | Yes |

| Do you supply a Registered Address/Virtual Office? | Yes |

| Local Director Required | No |

| Annual Meeting Required | No |

| Redomiciliation Permitted | Yes |

| Electronic Signature | Yes |

| Is Accounting/Annual Return Required? | Yes |

| Foreign-Ownership Allowed | Yes, any percentage, from any country (excluding “risky-ranged” countries) |

| Any Local Taxes? | Local tax 2%, other taxes depending on the scope of the activity |

| Corporate bank account requirements |

– the trading name of the legal entity and the types of activities to develop; – the statutory documents and the registered address; – the specimen signatures of the company’s representatives; – personal details on the shareholders and other corporate representatives. |

|

Documents for company registration |

– the personal documentation (ID/passport) of shareholders and directors; – documents attesting the owners’ address and tax identification number in Hungary; – the incorporation documents (the articles of association) of the Hungarian company; – if company formation in Hungary is conducted through another legal entity, which is the main shareholder, the latter’s incorporation documents and certificates are required; – the power of attorney, if the owners are represented by a third party. |

|

Visa requirements for businessmen |

Third party nationals must apply for suitable visas when relocating here for business purposes (through visas such as the Startup visa, the Investor visa, etc.). |

| Foreign investment programs available in Hungary | The investment programs available for foreign investors are established by the Hungarian Investment Promotion Agency (HIPA)and opportunities can be explored in many fields, such as life sciences, food industry, ICT, automotive, electronics, etc. |

| Institution in charge with the registration |

Company formation in Hungary is completed through the Hungarian Court of Registry. |

| Tax identification number for businesses |

Companies need a tax identification number, which is comprised of an 11 digits code. |

| Institution in charge with the tax registration procedures |

National Tax and Customs Administration Hungary. |

| Possibility to hire foreign workforce (yes/no) |

Yes |

| Obligation to be present for the incorporation formalities (yes/no) |

No |

| Duration of the corporate bank account setup | The bank account can be set up in a matter of 1-2 days, but the entire procedure (paperwork and others) can take minimum 2 weeks. |

| Minimum salary in Hungary |

HUF 232,000 per month. |

| How to obtain legal representation |

Foreigners can be represented in the process of company formation in Hungary by our consultants, if they grant us the power of attorney. |

| Institution in charge with immigration formalities |

Ministry of Interior |

| Shelf company type available |

Most of the shelf companies available for sale are incorporated as limited liability companies. |

| Minimum requirements for appointing directors |

– he or she has minimum 18 years old (the legal age in Hungary); – he or she has legal capacity; – there aren’t any residency requirements; – he or she has a clean criminal record; – persons who have been involved in corporate litigation involving financial claims are forbidden to hold directorship positions for a period of time. |

Types of business entities in Hungary

There are multiple types of structures from which investors can choose when deciding to start their business in Hungary.

The following types of companies can be set up in accordance with the Company Law in Hungary:

- sole proprietorships which are intended for those acting as sole entrepreneurs who engage in various crafts;

- partnerships which are general and limited and which require at least two founding members;

- limited liability companies which can be private or public and which imply respecting different incorporation requirements;

- subsidiaries and branch offices which are structures available for foreign companies seeking to operate in Hungary.

When trying to establish a large business, the Hungarian or foreign individuals can create a joint stock company (RT) which can be set up with a minimum share capital of 5 million HUF by a single individual or corporate body. It can be private or public. The shares issued by a joint stock company are registered at the Stock Exchange and have a predetermined nominated value. The management of such company is made by the board of managers and a supervisory board of at least three members.

A limited liability company in Hungary (Korlátolt Felelosségu Társaság – “Kft.) is based on a contribution of HUF 3 million. The management is made by a director appointed by the general meeting of the shareholders.

A Hungarian general partnership is composed by at least two members who share the same liability and responsibilities and can use the profits after paying the specific taxes on profits. The main advantage is that it doesn’t require a minimum share capital.

The Hungarian limited partnership is very similar with the above but it is formed by a general partner, with an unlimited liability and a limited partner that is limited by the capital contribution, monetary or non-monetary.

Depending on the business needs and objectives of every entrepreneur, he can choose whether to open a branch or a subsidiary in Hungary, or even start small, with just a virtual office in order to minimize his start-up costs. In case you are interested in expanding your business to another country, for example in Russia, we can put you in contact with a professional team of Russian lawyers.

Our experts in company formation in Hungary can offer detailed information on each type of business form and can provide you with tailored services when it comes to the establishment of the one you choose.

With regards to the accounting procedures of any of the Hungarian company types, you can rely on our accountants in Hungary, who can provide professional services, as per the rules of the Accounting Act.

The Accounting Act is harmonized with the European Union’s directives and other international accounting principles. It applies to all types of entities, associations and corporate structures.

Steps for company registration in Hungary

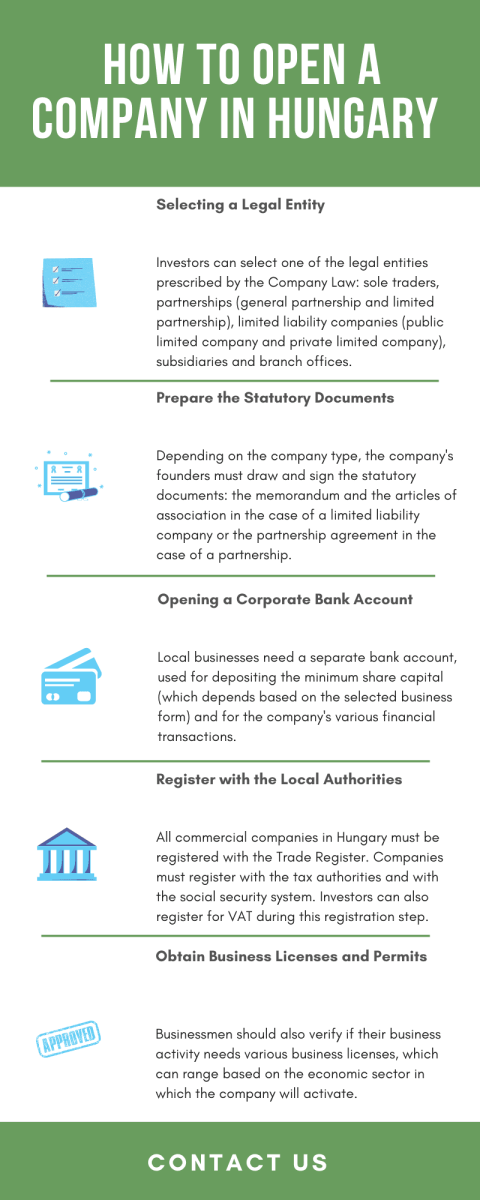

The creation of a business in Hungary implies the completion of various steps depending on the selected structure. Generally speaking, the main steps for starting a company in Hungary imply:

- selecting the legal structure and preparing the incorporation documents in accordance with it;

- setting up the corporate bank account in which the share capital will be deposited;

- finding a location that will seve as a legal address for the company to be incorporated;

- filing the statutory documents, information and application forms with the Trade Register;

- obtaining the tax identification number and registering for social insurance purposes;

- applying for the necessary licenses and permits with the authorities in the industry to operate.

VAT registration is not a mandatory requirement as part of the company formation procedure, however, it can be completed voluntarily in order to skip this step when the company reaches the mandatory registration threshold.

The corporate tax rate in Hungary is 9%. This country also levies a local tax of 2%, which is the only “automatic” additional tax. This means a tax rate of only 11%, one of the lowest in the EU. The VAT rate of 27% will not affect the businesses that purchase/sell products and services out of the territory of Hungary.

The easiest and cheapest way of owning a business in Hungary is by opening a new company. Once the company is incorporated, it will receive a registration number, tax and VAT numbers in just 1 or 2 days. In Hungary, the VAT number is obtained very fast, because there isn’t a designated authority for VAT registration. The VAT number is obtained by filling out the incorporation form and checking the box “Yes, I need an EU VAT number”. The Authorities automatically compose one from the 8 digit number of the inland VAT number.

Our Hungarian company formation advisors can offer foreign investors the necessary support in preparing the documents they need to file with the Companies Register. We can also advise on other matters such as the licensing procedures to be completed.

Documents related to company formation in Hungary

As mentioned earlier, the documents to be prepared in order to open a company in Hungary depend on the type of structure chosen. If for setting up a sole trader or partnership, the requirements are rather simple implying an application form, respectively a partnership agreement, when registering limited liability companies, the list of documents is more extensive.

The most important set of documents associated with the incorporation of a private and public limited liability company in Hungary are the Memorandum and Articles of Association which must contain information about the shareholders, the directors and their appointment, the share capital of the company, the legal address and the main object of activity.

These documents must be drafted and notarized by a public notary and then filed with the Trade Register alongside other information.

When creating branches and subsidiaries in Hungary, the parent companies are also required to file copies of their certificates of registration and Articles of Association.

We can assist with the incorporation of any type of company in Hungary. Once the investor decides the best structure for their needs, they can rely on us for guidance and assistance with all the preparations.

Incorporation procedure in Hungary

The process of company formation in Hungary takes around five working days as it is simplified by the possibility to register an entity electronically. It is advisable to hire a lawyer to represent the company, to create the company incorporation documents and make sure that all the legal actions are taken.

At least 50% of the subscription amount must be deposited in a bank account and a certificate of deposit is issued by it in order to be used in the incorporation process.

All the entities must be registered into the company register kept at the competent county court or the metropolitan court. After depositing the application, the Court will also register the entity at the State Tax Authority and with the Statistical Office. Not more than two days are necessary for the entire process.

The last step of company incorporation in Hungary is the registration at the Social Security. The procedure is simple and takes 1 day to be completed. In case you would like to establish a company in Moldova, we can put you in touch with our partners.

Opening branches or representative Offices in Hungary

For a foreign company, there are the options of opening Hungarian branches or representative offices. Neither of them has the status of a legal entity. A representative office is easy to administer and the closure doesn’t require deregistration. Non-residents who want to start a company in Hungary can operate a business in this jurisdiction through a branch registered with the Court of Registration. The necessity of a business license is applied in this case as well. The books and financial statements must be kept in accordance with the Hungarian law.

Representative offices have to be registered at the Hungarian Court of Registration. It is not allowed to engage in any commercial activity. A representative office may assist in the preparation of contract and provide advertising services on behalf of the parent entity. Neither of the two entities requires a minimum share capital.

Our specialists can provide consultancy in both formation and management of companies in Hungary. We can also help our clients take advantage of the double tax treaties signed by Hungary.

The video below offers a short presentation on the process of company formation in Hungary:

How long does it take to open a company in Hungary?

The following timeframe must be considered when setting up a business in Hungary:

- – the preparation of the registration documents takes one day to complete;

- – the opening of the corporate bank account will take another day;

- – the incorporation and issuance of the certificate of registration from the Trade Register can take up to 15 days;

- – the registration for social insurance purposes will take another day to complete.

Foreign investors interested in why they should open a company in Hungary, should note that:

- – in 2018, Hungary received Foreign Direct Investments (FDI) worth 6.3 billion USD;

- – in the same year, FDI represented 57% of the country’s Gross Domestic Product (GDP);

- – between January and October 2019, Hungary received 62 new large investment projects thanks to the Investment Incentive Scheme;

- – Hungary ranks 52nd in the World Bank’s 2020 Doing Business Report, a place higher than last year.

{pyro:chestionar:chestionar}

Frequently Asked Questions on How to Open a Company in Hungary

Starting a business in Hungary as a foreigner or as a local implies several phases, from choosing the most suited type of company for your business objectives to company registration. There are many details that a foreign investor or entrepreneur should know before opening a company in Hungary. Our Hungariancompany formation specialists prepared a comprehensive list of frequently asked questions related to the process of establishing a business in this country.

1. Can a non-resident set up a company in Hungary?

Yes. Foreign investors interested in opening companies in Hungary benefit from the same treatment as in the case of local investors.

2. How long do I have to wait in order to incorporate a company in Hungary?

The process of company formation in Hungary lasts for about 5 working days if all the documents are in order and if all the requirements are fulfilled. Asking for the help of a company formation firm in Hungary is the best way to proceed when incorporating a company in the country. Our company registration experts in Hungary can assist you through the entire process of incorporating a company in Hungary.

3. What are the costs for opening a company in Hungary?

The business start-up costs in Hungary vary depending on the type of company you intend to set up here and on the additional services you may choose for your new business. Our company incorporation experts in Hungary advise you to send them a detailed e-mail with your business project in order for them to analyze it and answer you with a personalized offer.

4. What are the main steps for company incorporation in Hungary?

The main steps in order to start a company in Hungary are as follows:

- – choosing the type of company;

- – choosing a name for your company and wait for the approval of the Company Registrar in Hungary;

- – compile the application in order to register your new company with the Company Registrar in Hungary.

5. Do I need to deposit a minimum share capital at the incorporation in Hungary?

Depending on the type of company you choose to incorporate you may be obliged to deposit a minimum share capital. There are several legal entities in Hungary that require a minimum share capital, such as: the limited liability company (Kft.), the private company limited by shares (Zrt.), the public company limited by shares (Nyrt. or Rt.). Our specialists in company formation in Hungary can provide you with more details about the initial amount required by each legal structure.

6. How can I set up a bank account in Hungary?

In order to open a bank account in Hungary you must present a passport or a Hungarian ID card as proof of identity. If you are an expat or a foreign entrepreneur who is interested in opening a business in Hungary, our local experts can help you open a bank account in Hungary .

7. What documents do I need in order to open a company in Hungary?

The main documents you need to submit with the Trade Register in Hungary are:

- – the commercial license;

- – documents of incorporation which will include the following information: the address and the unique name of your company, the activity and the type of the company;

- – the receipt of the bank account.

Our Hungariancompany formation expertscan provide you with complete guidance through the entire registration procedure.

8. What taxes do I have to pay for my new company in Hungary?

Regarding the corporate taxation in Hungary, you should know that the value of the corporate tax is 9%.

9. Do I need business permits or licenses in Hungary?

There are some industries in Hungary that require a special business permit, such as:

- – the mining sector;

- – the trading industry;

- – the construction sector, etc.

10. Why should I invest in Hungary?

The main 5 reasons for investing in Hungary are the following:

- – good geographical location;

- – well trained workforce;

- – business friendly environment;

- – a favorable tax system;

- – government incentives.

For tailored company formation solutions in Hungary, please contact us.

CompanyIncorporationHungary.com is a part of Bridgewest.eu, a European and offshore company formation agent which has affiliated partners throughout the world, including Hungarian and Polish lawyers who can provide local legal assistance to foreign investors.